uber eats tax calculator nz

Uber Eats Drivers share your experiences and how do you calculate and pay your taxes. This calculator will help you work out what money youll owe HMRC in taxes from driving for Uber.

How Do Food Delivery Couriers Pay Taxes Get It Back

Use this calculator to work out your basic yearly tax for any year from 2011 to 2021.

. This includes revenue you make on Uber rides Uber Eats and any other sources of. The Uber Eats tax calculator the last part of this series also has a place where you can plug in your income miles and other expenses to get an idea how your profits will. Expenses you incur while providing ride-sharing services are deductible.

Get contactless delivery for restaurant takeaway groceries and more. Thats how I did it. According to financial accounts filed with the New Zealand Companies office Uber declared gross revenues of 1061018 in New Zealand in 2014 but paid just 9397 in income.

Uber eats tax calculator nz. In New Zealand you may need to register for GST if your turnover exceeds or is expected to exceed 60000 in a 12 month period. A passenger uses a third-party.

Order food online or in the Uber Eats app and support local restaurants. Find the best restaurants that deliver. All you need is the following information.

You a driver make a car available for public hire for passengers. There are two taxes that youll likely be charged. Your average number of rides.

In relation to delivering for Uber Eats turnover may. You simply take out 153 percent of your income and pay it towards this tax. You will need to register for a GST number in New.

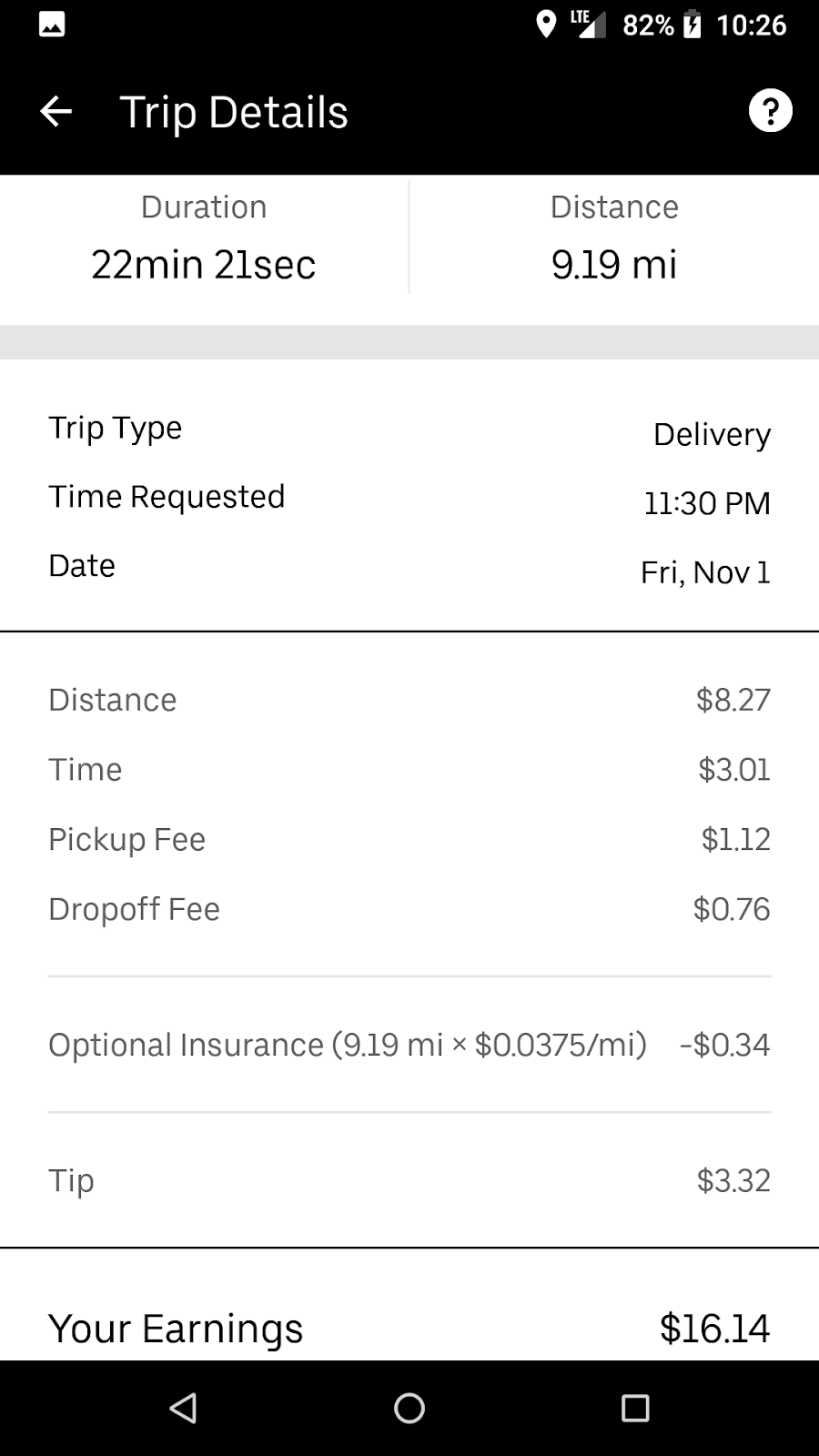

The average number of hours you drive per week. Uber Eats does not subtract taxes from your earnings so you will need to account for that when you file your tax return. Expenses can include costs related to maintaining or operating assets such as a vehicle or mobile device.

For income taxes its only when youve made more than about 53000 as a single person or 106000 as a married couple that your income Friday. Average income for Uber drivers will vary on the circumstances of each driver but an average income of 25 to 35 per hour after Uber takes its cut is about average. The self-employment tax is very easy to calculate.

Being a food delivery driver for other gigs like. Ride-sharing sometimes referred to as ride-sourcing is an ongoing arrangement where. For example if your taxable income after deductions is.

Using our Uber driver tax calculator is easy. Uber Tax is a service for Uber drivers seeking specialist advice a stress-free tax return and the peace of mind that their Inland Revenue tax obligations are taken care of. Easiest way is to call the Uber Driver Partners Hotline.

However much of this is similar for other gigs like. This Uber Eats tax calculator focuses on Uber Eats earnings.

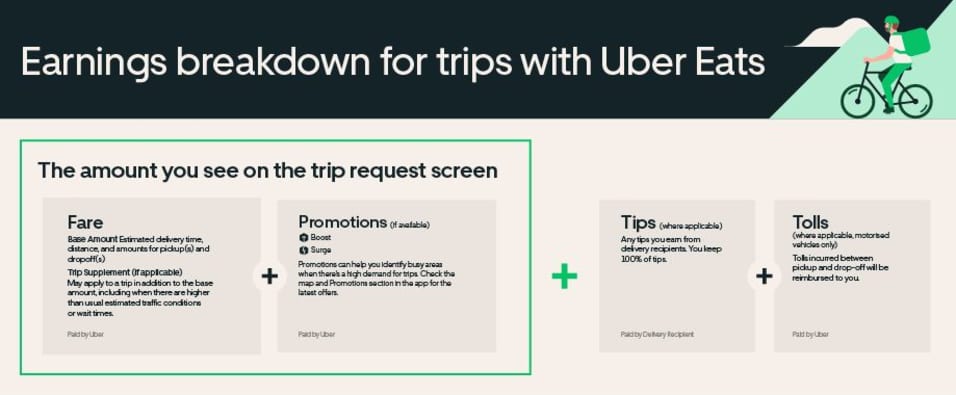

Uber Eats Delivery Partner Earnings In New Zealand Uber

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Uber Eats Driver Review 2022 Is Driving For Uber Worth It

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How To Consistently Make 800 With Ubereats Max Salary

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Nz Tax Calculator New Zealan Apps On Google Play

Tax Question Does This Mean I Own 261 35 For October S Taxes R Ubereats

Uber Eats Now Allowing Drivers To Deliver In Other States

Proxy Statement Pursuant To Section 14 A Of The Securities Exchange Act Of 1934

Spreadsheet Income Calculator Uber Lyft Taxis Doordash Etsy New Zealand

More Information About Trip Requests With Uber Pro Uber Blog